Filing 2021 taxes will become more complicated this year for people with pandemic-related tax credits for sick leave, small business grants, and other new considerations. Some of that complexity can be smoothed over by using the dominant package in tax reporting, TurboTax, created by financial software powerhouse Intuit. See also: How to file your taxes if you received unemployment benefits in 2021. The program can guide you step by step through the question and answer process of adding up your income, your expenses, and your special deductions. Then, the software can either electronically file your return or give you printable forms to send by mail. Some government tax forms are not finalized – and may not be for another month – but TurboTax will let you get very far along in the process in just a couple hours’ time. That is, assuming you have at least a rough idea of what is going to show up on your W-2s and 1099s. There’s an extra incentive to get started now, which is that TurboTax offers discounts on the software price for those who start early.

The offerings

TurboTax has three product categories: online filing using a web browser; a human-assisted online version called TurboTax Live, where a CPA will field questions and also chat with you via video session; and the old-fashioned download route, where you get a desktop app that runs the software outside of the browser. TurboTax has expanded the Live offering with a Full Service version, which is akin to hiring an accountant to do all the work for you (albeit for a more affordable price). The prices range from free using the online option, to $120 for the Home & Business CD/Download version that will handle such forms as 1099s. State filings are free with the free online product option, but extra for all other online products. The CD/Download products are priced based on both the preparation of the state paperwork and the actual electronic filing charge – that is if you decide to file electronically rather than mail in your paperwork. The online products, including the Live versions, let you start out your work without any charge and pay only when you file. The free product is free to file, including the state filing charge. Bear in mind, TurboTax has add-ons that you can purchase as an à la carte offering, including something called “Max Benefits” that adds features such as “Full audit representation” that will enlist a “dedicated expert” to represent you to the IRS if such an event befalls you. See also: Five ways you’re asking for an IRS audit this tax season. If you choose to add Max Benefits during the process, it’s an additional $59 versus the $125 cost of adding it à la carte. In addition to the main programs, TurboTax has quite a roster of mobile apps. Not only does the TurboTax Mobile App for iOS and Android let you do all the work from your phone, but there are two more companion mobile apps: TaxCaster, which is a quick-and-dirty program for getting a rough estimate of your potential tax refund, and ItsDeductible, which is a program for keeping track of your charitable gifts. Remember that when you are ready to file, there is an option to choose to have the cost deducted from your refund in cases where you are entitled to a refund.

The online experience

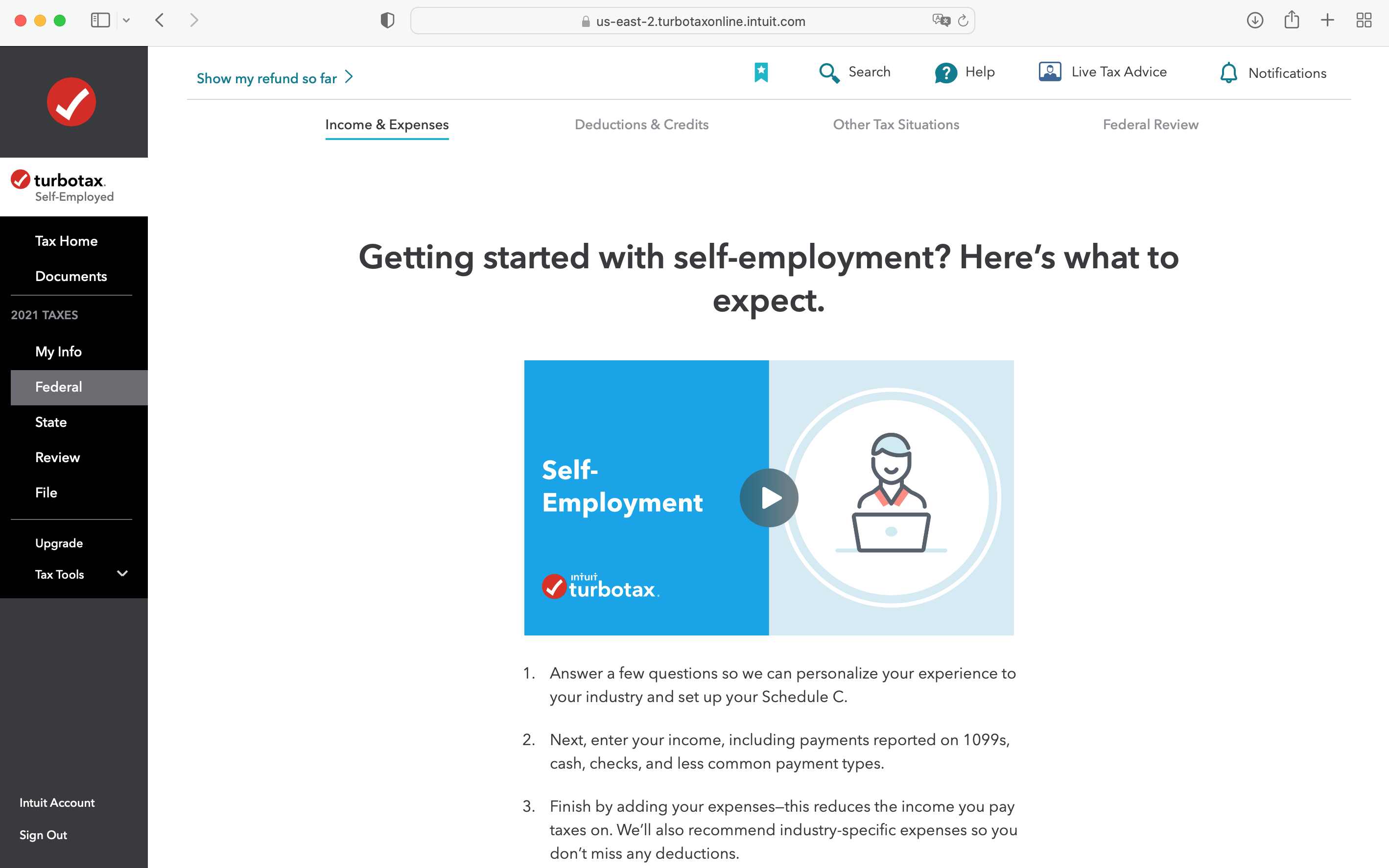

The online versions whisk you right into the process once you decide which of the four versions you want to use: Free, Deluxe, Premier, or Self-Employed. If you are a returning user, the program will prompt you to login with a previously established user ID and password. The program then asks about life-changing events, such as buying a home, and new situations in the tax year, such as having sold cryptocurrencies or changing employers. The question-answering funnels you into a series of document preparation steps, with encouraging verbiage on-screen along the way, such as “You’re speeding toward the finish line!” See also: Here’s how 2021 tax brackets actually work. An interesting aspect is the information pop-ups that accompany some screens, such as financial relief options to consider to get money back. These appear as a sidebar to the main content in the window, so they’re helpful without taking you out of the flow of what you were doing. Because it’s part of Intuit, a number of extra possibilities pop up during the course of the online exercise. For example, you can import your financial data from Intuit’s Quicken program or QuickBooks. And the program will ask if you want TurboTax to allow Intuit to access your filing data for the purpose of giving you feedback, such as “analysis to help you understand where you stand financially across your income, credit score, and debt-to-income ratio, and tips to help you improve and get more of what you want.” (You can choose not to use the extra options.) If you walk away from the web site, TurboTax will log you out after a while. Sometimes the program may take you back to a step you’ve already done when you return; it doesn’t always pick up exactly where you left off. Among the best aspects of TurboTax’s online offering is how it gives you a sense of what’s coming up next, such as an overview of the income reporting process. It’s a little thing, but having plain-English web pages that preview the coming steps is helpful in an already psychologically fraught process. The company does a good job of walking you through the categories of expenses you will have to itemize, giving you a sense of where you are in the journey. A nice feature is a constantly updating estimator at the top of the page showing how much you owe for both federal and state taxes. See also: To itemize or not to itemize? That is the question. You can, at any point, click on the Live option button in the upper right corner of the site to chat with a CPA, for the additional fee mentioned above. A person appears in a video window, so you can see them but they cannot see you. They introduce themselves and ask for permission to view your screen. What they can see is only a single browser window, and only the open tab of that window, so the engagement is kept focused. In ZDNet’s experience, talking with the tax pro was a pleasant and helpful experience. TurboTax is also very forgiving when you fail to fill in something, such as missing the dollar amount when noting what’s in your 1099-NEC. However, one wonders why such things are not more automated, such as transferring your 1099-NEC info right out of the actual stub. In fact, TurboTax Online does offer an ability to snap a picture of a 1099-NEC and have it automatically populate your filing, a new feature this year in the Self-Employed version. That feature is mentioned prominently both on the site and in the mobile app, but ZDNet searched in vain to find the place to snap a picture of the NEC. This is a potential problem of the online edition. New features are updated at various times, and within TurboTax’s very rich offering, some features seem to be either not available early in tax season or buried, like the 1099-NEC photo option. ZDNet called technical support – twice – to inquire about the missing 1099-NEC upload feature. Both times, an automated support response tried to redirect to some online literature, but that didn’t solve the problem. The key in this case is to tell the automated attendant, “I want to speak to a person,” whereupon you’ll be passed to a tax pro. The tax pro was not, in this case, able to solve the mystery of the 1099-NEC feature, suggesting that it has yet to be rolled out. Somehow, TurboTax needs to do a better job of surfacing these kinds of features and making sure they’re available when they’re heavily marketed.

Conclusions

TurboTax has the most comprehensive selection of products, from a free online form that lets you do federal and state filings for free up to a $389 product that basically has an accountant take over everything. The presentation of the user interface in the online product is one of the best around, with simple, straightforward descriptions of tax concepts, such as depreciation versus expensing, that can clarify some of the mystery of the process. The company needs to be careful, however, not to advertise a million features that don’t easily show up when people expect to use them, such as automatically scanning 1099-NECs. Also, some of the costs are buried in the fine print and can be confusing, so scroll through the entire page and read carefully.